Evaluating the Effectiveness of Quantitative Easing

- Neiladri Chakravarty

- May 22, 2024

- 7 min read

Updated: Jul 21, 2024

by Annika P, Kaashvi M, Mehak S, Param RJ, Tatva C hauhan

Summary. Quantitative easing (QE) is a tool used to boost economic activity during slowdowns or recessions. QE increases money supply by injecting money into the economy through the central bank’s purchase of assets and has been a central tool for stimulating economies. However, its effectiveness and long-term impact are up for debate.

Quantitative Easing is a monetary policy instrument used by Central Banks of countries. Central Banks such as the Federal Reserve and Reserve Bank of India(RBI) purchase securities in the open market to reduce interest rates and stimulate the money supply in the market. The strategy was first introduced by the economist Professor Richard Werner in 1995 and has been since employed by many countries worldwide.

Global Comparison of QE Strategies

Quantitative Easing is a fairly recent monetary policy strategy. It was first given rise to in Japan but has since been employed by many countries worldwide. The countries that have employed QE strategies the most are the USA, the UK, Europe, and Japan.

Japan has used Quantitative Easing for more than 15 years, starting unofficially from 1997 till its most recent Quantitative Easing Program in 2013. During the period between March 2001 and December 2004, the Bank of Japan injected a significant sum of 35.5 trillion Yen into Japanese Banks. The Bank also concentrated its efforts on procuring long-term government bonds, which lowered asset yields. Japan's economic growth improved between 2002 and 2007 but during the Great Recession, Japan’s growth reduced exponentially as did the economy of most of the world. Japan's most recent round of Qualitative Easing was in 2013. The Bank of Japan launched a round of Quantitative and Qualitative Easing (QQE) in 2013. The round was not a successful move, a purchase of more than 80 trillion yen was not enough. In October 2014, Bank of Japan announced a second round called QQE2. The Japanese stocks grew by 33% but it was still not considered a substantial growth and thus the Bank of Japan announced negative interest rates in 2016.

Source: Ministry of Finance, Japan

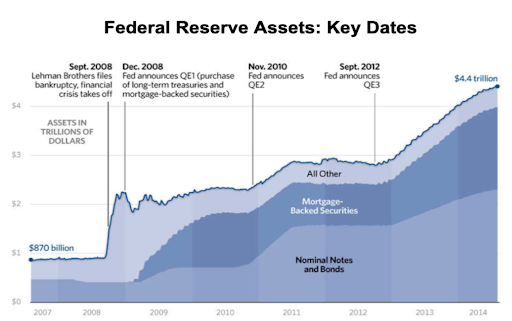

Following the housing market's collapse, the Federal Reserve employed Quantitative Easing to stabilise financial markets and support economic recovery.

The first Quantitative Easing was launched in late 2008 and large amounts of debt and mortgage-backed securities were purchased to boost liquidity. As the condition of the economy worsened, the program was expanded. In 2010, the Federal Reserve initiated QE2 in response to the low inflation and economic stagnation and purchased more securities. This was followed by ‘Operation Twist’ to boost borrowing. This operation involved selling short-term bonds and buying long-term bonds to lower interest rates. Despite the efforts of the Federal Reserve, the economic recovery was slow. This led to QE3 in 2012, involving open-ended purchase of assets, primarily mortgage-backed securities until the economy improved, scaling back starting December 2013 till October 2014.

While the economy recovered, the true contribution of quantitative easing to overall growth is a topic up for discussion. Quantitative Easing undeniably calmed the market, but its ability to trigger significant economic expansion remains uncertain.

Source: Board of Governors of the Federal Reserve System

Financial Market Dynamics

One of the products of QE is low interest rates that make, for example, the stocks as an investment, more appealing than the fixed-income assets when considering the risk-return profile. Moreover, the purpose of those monetary policies is to encourage investors to be over-optimistic, which results in stock price growth. Investors who are in search of higher returns will divert their money to the stock market, and this in itself dramatically increases the index of the stock exchange.

Moreover, Quantitative Easing ostensibly has an impact on the yields of bonds. As central banks like the Federal Reserve Bank or the Bank of England buy government securities, the amount of these relatively secure assets on the market drops, which brings down the yield and pushes the price up.

The unprecedented flooding of capital resulting from QE leads to a multiple times increase in the trading numbers. With changes taking place both in the central bank policy and the economic fundamentals of the market, investors cannot change their fund distributions due to the rising activity in the market.

The supply of liquidity reduces the spread between Bids and Offers, which is the difference between the buy and sell prices. In the trading process, shares that the sellers will be willing to sell at a lower price and the buyers will be ready to purchase at slightly higher prices. Such competitive trading leads to the deepness of the bond market, i.e., as prices drop down, a big demand enters the market. When this happens in possibility, the direction is either up or down depending on the investor.

Low interest rates prompt investors to try to find higher returns in more content like high-yield bonds or emerging market securities. This can inflate asset prices beyond their underlying fundamentals, potentially leading to asset bubbles and increased market volatility. Low borrowing costs and easy money incentive leverage and speculative behaviours. People can borrow a lot of money to add more money to their portfolios or use speculative trading techniques. This can promote market drops and further increase systemic risks that may exist in the financial system.

QE can lead to a depreciation of the domestic currency. This makes exports cheaper and imports more expensive, potentially boosting exports and aiding domestic producers. Lower interest rates incentivize banks to lend more readily, as borrowing becomes cheaper for businesses and consumers. This can stimulate economic activity and investment. QE can lead to increased investment in ETFs, as they offer diversified exposure to different asset classes. This can further amplify the impact of QE on various market segments.

Macroeconomic Factors

QE is estimated to increase the GDP growth by increasing money supply in the economy leading to an increase in cash flow which helps in the overall GDP growth. An investigation by the International Monetary Fund(IMF) in 2019, studied the impact of QE on economies and found that it can provide a boost to GDP growth, especially in the short term. The study found that a 1%-increase in the central bank's balance sheet ratio could lead to up to 0.2%-increase in GDP growth.

Source: Bloomberg Professional (CME group)

The above figure shows the differences between the US's actual GDP and its backwards-looking estimate. In this case, the differences are more substantial. Initially, QE helped to dampen the decline in GDP in the short term, with the difference between actual and backcast GDP being above 3%. Over the years, it can be seen that QE has helped smoothen the cycle. As GDP growth before the fourth phase of QE would have been stronger than actual growth with the contribution of quantitative easing, this can be a testament that QE can be quite effective in the short term but its side effects can counter its positive impacts in the long run therefore bringing no positive impact on the GDP. Again, we found the response to COVID-19 wherein such an economic decline could not have been forecasted.

Inflation rates tend to increase with an increase in money supply followed by an increased demand for commodities and other products. Countries use QE to push up their inflation rates and meet their inflation targets. Reports suggest that “quantitative easing has a stronger inflation effect than conventional monetary policy”. From an examination of 82 previous studies of QE and conventional monetary policy, testing for a difference in means through a t-test shows that the inflation effects of QE are two to four times higher than those of conventional monetary policy in the UK and the US.

An increase in the money supply due to QE can lead to a devaluation of the domestic currency. This can have both positive and negative effects. On the one hand, a weaker currency can make a country's exports more competitive in the global market, boosting export-oriented industries and leading to economic growth. On the other hand, a weaker currency can also lead to higher import prices, contributing to inflation.

Policy Challenges And Trade-Offs

While quantitative easing is a credible monetary policy tool, its deployment is not without challenges and potential trade-offs. One such challenge faced due to quantitative easing was following the 2008 financial crisis. It was during this time that the Federal Reserve, the European Central Bank, and the Bank of England deployed quantitative easing programs to balance the market conditions. This has generated concerns about its long-term effects such as financial market deformation and the possibility of future financial instability.

Another challenge posed by QE is the exit strategy. Exiting from QE is a crucial process. It requires central banks to normalize the interest rates and reduce the balance sheets. This not only causes an impact on financial markets but can also threaten economic recovery efforts and cause vulnerability in banking sectors.

In May 2013, the Federal Reserve chairman made hints about tapering the Fed’s quantitative easing program. It raised the bond rates and financial markets became more strained due to that concern. It attracted attention as to how the financial markets get affected by the tapering/exit strategy of quantitative easing.

Source: Uc3onomics

Quantitative easing (QE) is frequently compared with other monetary policy tools, each carrying distinct trade-offs.

Interest rate cuts are one of the alternatives to quantitative easing. It helps in assessing the economic activity of a country. It is an effective monetary tool but when the interest rates hover to zero, this tool becomes ineffective. Opting for quantitative easing becomes more relevant as it generates better stimulus.

Another alternative is credit easing. It involves purchasing various bonds and assets such as mortgage bonds and corporate bonds. As the name suggests it tries to improve the credit conditions of the country. While it is effective, it becomes pale in comparison to quantitative easing when it comes to the economic approach towards a country.

Helicopter money on the other hand involves money inclusion in the country through the purchase of various assets. This tool is instrumental for managing aggregate demand and deflationary pressures. Quantitative easing is generally preferred to helicopter money because it carries low risk and has a built-up infrastructure.

Since the growth of QE as a monetary policy tool it has been employed in various economies throughout the world and while it has helped improve the short-term economic growth and the inflation rates, its long-term effects are a highly debated issue. Through our research and findings we have concluded that while QE does benefit the economy in the short run, it is not sustainable in the long run.

Comentários